Wow, this comes as a shocker. As a former long-time baseball card collector, Topps has always been a company that’s very dear to me. Now Michael Eisner, the cutthroat former CEO of Disney, is trying to take over the card manufacturer. Everything in Major League Baseball is going corporate, so this is no surprise. Michael Eisner was the guy who tried to replace Walt Disney, schmoozing with Mickey and Goofy during the intros to the Wonderful World of Disney TV show. Walt Disney was one of the most creative visionaries of our era. Will Eisner is a hack who ripped off the Disney empire and doesn’t have one creative bone in his entire body. If the group he represents takes over Topps, it will be a disaster and a travesty.

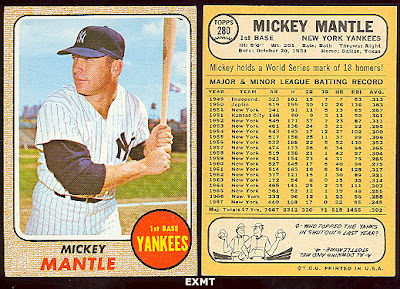

Wow, this comes as a shocker. As a former long-time baseball card collector, Topps has always been a company that’s very dear to me. Now Michael Eisner, the cutthroat former CEO of Disney, is trying to take over the card manufacturer. Everything in Major League Baseball is going corporate, so this is no surprise. Michael Eisner was the guy who tried to replace Walt Disney, schmoozing with Mickey and Goofy during the intros to the Wonderful World of Disney TV show. Walt Disney was one of the most creative visionaries of our era. Will Eisner is a hack who ripped off the Disney empire and doesn’t have one creative bone in his entire body. If the group he represents takes over Topps, it will be a disaster and a travesty.The baseball card pictured above is a 1968 Topps Mickey Mantle. When I was 10 years old, it was the one card I would have given up anything for , including my bicycle, my slingshot, my walkie-talkies and my little brother.

This article appeared on aol.com yesterday:

NEW YORK -- The Topps Co., maker of baseball cards and Bazooka bubble gum, agreed to accept a $385.4 million takeover offer from a buyout group that includes former Disney chief executive Michael Eisner.

Topps, founded in 1938, makes trading cards featuring athletes of Major League Baseball, the NFL and NBA.

Eisner was CEO of The Walt Disney Co. for two decades until he stepped down in 2005. Disney owns theme parks, movie studios and the ABC, ESPN and Disney TV networks.

The deal drew immediate opposition from Topps director Arnaud Ajdler, who said Tuesday he had not yet been in touch with other major shareholders. He thought the deal should be abandoned because negotiations did not go through a proper process and that the Eisner-led offer undervalues the company.

The board approved the deal in a 7-3 vote, with Ajdler and two others opposed. The company said it will solicit better offers over the next 40 days. The deal requires regulatory approval and a vote by Topps shareholders.

AP NEWS

Topps, founded in 1938, makes trading cards featuring athletes of Major League Baseball, the NFL and NBA.

Eisner was CEO of The Walt Disney Co. for two decades until he stepped down in 2005. Disney owns theme parks, movie studios and the ABC, ESPN and Disney TV networks.

The deal drew immediate opposition from Topps director Arnaud Ajdler, who said Tuesday he had not yet been in touch with other major shareholders. He thought the deal should be abandoned because negotiations did not go through a proper process and that the Eisner-led offer undervalues the company.

The board approved the deal in a 7-3 vote, with Ajdler and two others opposed. The company said it will solicit better offers over the next 40 days. The deal requires regulatory approval and a vote by Topps shareholders.

AP NEWS

No comments:

Post a Comment